Table of Content

Mortgage customer service solutions are now available, at your fingertips! Access a host of mortgage services, such as rate conversion and part payment, all contactless, without the inconvenience of visiting any branch. Moreover, our services online are safe and secure, so you can be stress-free, while carrying out all your transactions. Write an email from your registered email id which is linked with the account by providing complete information to request your submitted home loan application status.

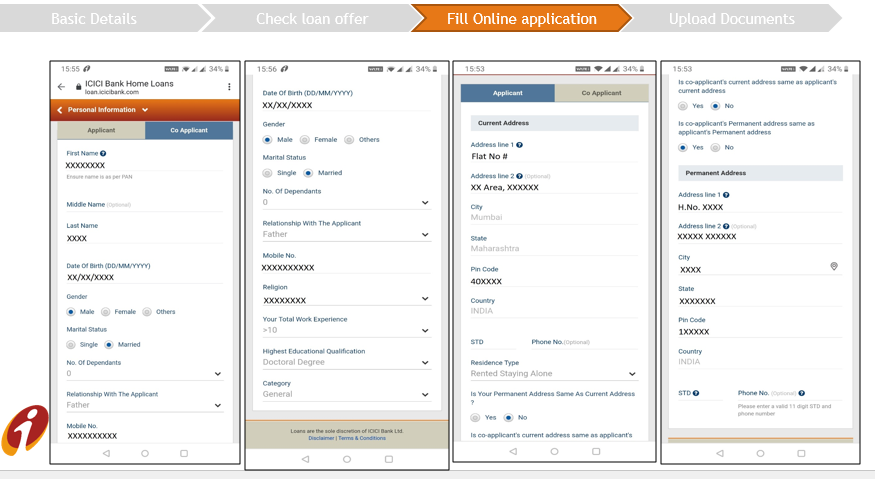

You can increase your eligibility by adding a co-applicant like your spouse or any immediate family member. What’s more, you can transfer your existing home loan balance at a lower rate of interest and reduce your EMI burden. Those who already have an account can proceed by clicking on ‘I already have an account’ tab.

ICICI Bank Home Loan Application Status

Select the Loans section from IVR Options, then choose ‘current status‘. Select ‘Track New Loan Number‘ and provide the required information. Go to the Loans Section through the main menu options. Recheck the information and verify for any corrections.

Once open, proceed to “create new account” follow the page instructions to complete the process.Here the user will create a login PIN or use a fingerprint as a login credential. A refreshing way to learn all about Personal Finance. Campus Power - from a dream to a degree, with you at every step.

ICICI Home Loan Online Application Status Check | ICICI Home Loan Interest Rate

Many Indian residents can fulfill their dreams to own a home with the help of ICICI bank India. The opportunities come at low-interest rates and better payment tenure of up to 30 years. ICICI bank is a famous private sector bank with various beneficial offers to all customers. The bank ensures to provide products that suit every user’s financial range. There are different types of ICICI house loans based on the user’s needs and financial ability.

You will also have to specify if you are interested in the bank’s cashback offer. Click the ‘Submit’ button after filling in all the details. On the screen that appears, key in your application number along with your mobile number and press ‘Send OTP’. After this, you will receive a One-Time Password on your mobile phone.

How to Check ICICI Home Loan Application Status

ICICI Bank typically takes 3-7 working days to sanction the loan post verification and processing. You can keep a track of your home loan by checking your home loan application status. You can check your ICICI home loan application status either online or offline. You can visit your nearest ICICI Bank branch or check online via ICICI TrackMyLoan. Click here to check your home loan application status.

Select the ‘Know more’ tab under the ‘Home Loan’ section and the applicant will be redirected to the ‘Know Your Application Status’ page. With effect from November 20, 2022, new Mortgage Loan charges are being introduced. Please find below, the list of charges applicable. They will explain everything about the application status. Enter your application number and mobile number and click ‘Send OTP‘. The application status will be displayed on the screen.

Steps To Check ICICI Loan Application Status

A home loan application can be extensive and requires information such as – the applicant’s identification, proof of address, age, credit history, CIBIL score, employment status, etc. Once the applicant fills out and submits the application, ICICI will perform its due diligence and decide whether or not to approve the loan based on the borrower’s ability to repay. The ICICI bank website page is open to all bank customers to help avail any banking service. The home loan applicant can also check the status of the application through the official website. Eligible ICICI bank customers should provide the following documents before the home loan application process. ICICI mobile app is a simple feature available on a user’s mobile device.

ICICI home loan is an excellent lending option for individuals in need of fast cash to purchase a new plot/house or remodel an existing one. The bank lends higher amounts of the loan with the lowest per cent for a maximum term of 30 years. Review the details on the pageEnsure they match your bank account records. By continuing to use the site, you are accepting the bank's privacy policy. The information collected would be used to improve your web journey & to personalize your website experience. A home loan is essentially a financing option where funds are provided to an individual or an entity for the purchase, construction, extension, or renovation of a residential property.

Next, click the ‘Submit‘ button to display the current status of the home loan application. Address proof documents such as utility bills, DL, PAN card, passport, and more. I was skeptical at first, since it is generally not easy to get things done online in India. To my surprise, the entire home loan process was very quick and I had constant support and help from my relationship manager. I was briefed in detail about documentation, timeline and process.

Explore a vast database of 40K+ ICICI Bank approved projects by leading developers, across 44 locations in India. The contact numbers of your relationship manager, sales personnel and Customer Care executive will be displayed on your trackmyloan dashboard. You can contact them in case you have a query in your Home Loan journey. Track your ICICI Personal Loan Application status easily, by filling several details such as Date of Birth / Mobile Number and Application Number. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

You can check your loan application status through various online channels like the official website of ICICI Bank, through the ICICI TrackMyLoan service, and the ICICI iMobile smartphone app. For more information, refer to the ‘How to check ICICI home loan application status online? The sanctioning of the home loan application can be an extensive process, from verification to disbursement of the loan amount. Different banks have different processing times, depending on their internal processes.

Rs. 500/-plus applicable taxes and other statutory levies, if any. Rs. 300/-plus applicable taxes and other statutory levies, if any. Rs. 100/-plus applicable taxes and other statutory levies, if any.

You can get a home loan for an under-construction property, ready-for-possession property, builder property or a resale property. Under section 80C of the Income Tax Act, you get a deduction for the principal loan amount repaid up to ₹ 1.5 lakh a year. On this page towards the end, you will find the Home Loan Service section, under which the tab, ‘Track Loan Status’ would appear. Yes, you can sell the property, even if the loan is running. If you have not satisfied with IVR’s reply you can connect with a phone banking officer.

No comments:

Post a Comment